Securing Top Talent: How Life Insurance Benefits Boost Executive Recruitment and Retention

Executive compensation and benefits have long been pivotal in attracting and retaining top-tier talent within organizations. As companies vie for the best leaders, they often employ a variety of incentives to make what they offer more appealing. Among these incentives, life insurance has long been viewed as a significant component, offering tax benefits, flexibility and providing executives with a sense of security for their future and that of their families.

For over 40 years, Windsor Insurance Associates has actively supported agents in the marketing and sale of life insurance policies designed for the Executive Benefits market. So we were pleased to read, in a recent NFP publication titled 2024 NFP US Executive Compensation and Benefits Trend Report, that benefit plans featuring life insurance are among the top plans ranked by over 200 executive benefit decision-makers and business leaders.

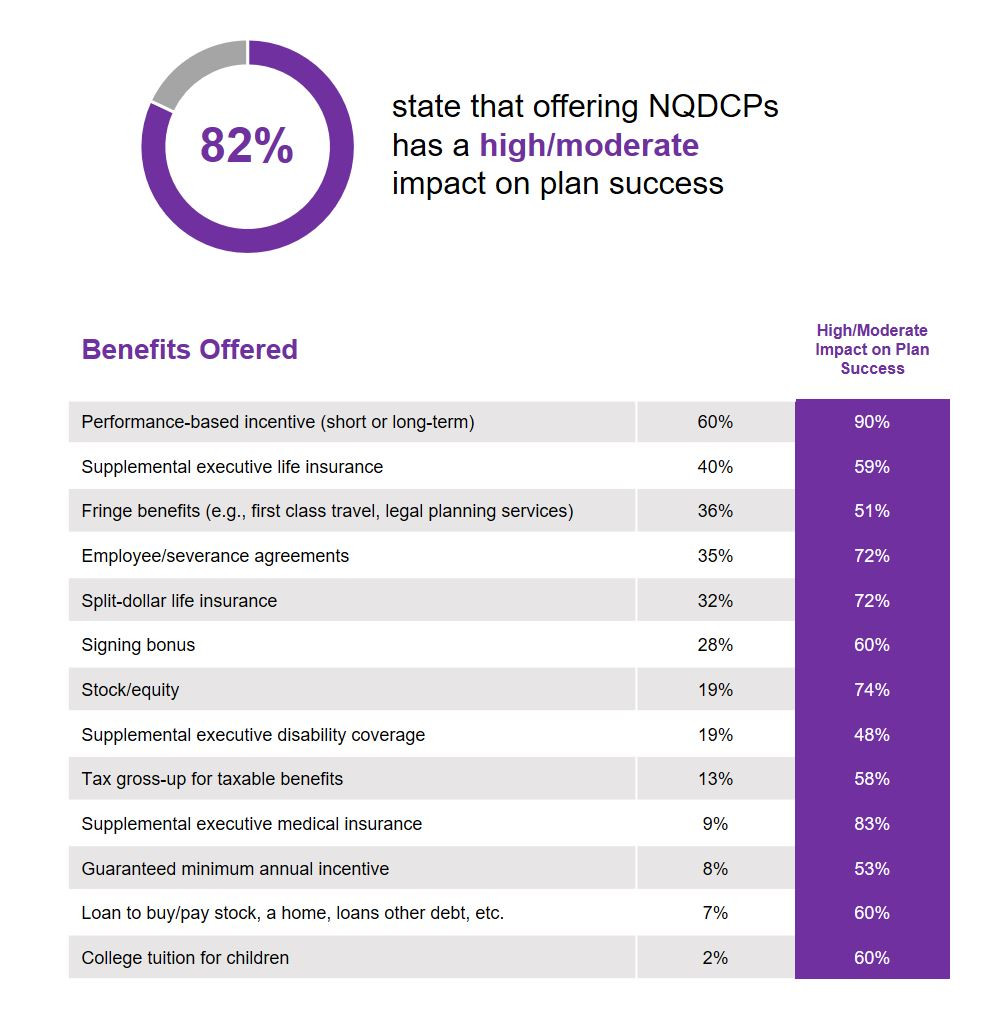

The importance of life insurance as an executive incentive is not only a testament to its intrinsic value but also reflects the evolving landscape of executive expectations and the increasing responsibilities shouldered by corporate leaders. In NFP's survey, Non-Qualified Deferred Compensation, Split Dollar plans, and Supplemental Executive Life Insurance all ranked highly regarding their impact on the success of an overall benefit plan.

The insights gleaned from this survey are invaluable for HR leaders and board compensation committees, providing benchmarks that aid in crafting competitive, and sustainable, executive benefit strategies. In the following discussion, we'll review the uses of life insurance in Non-Qualified Deferred Compensation, Split Dollar, and Supplemental Executive Life Insurance plans.

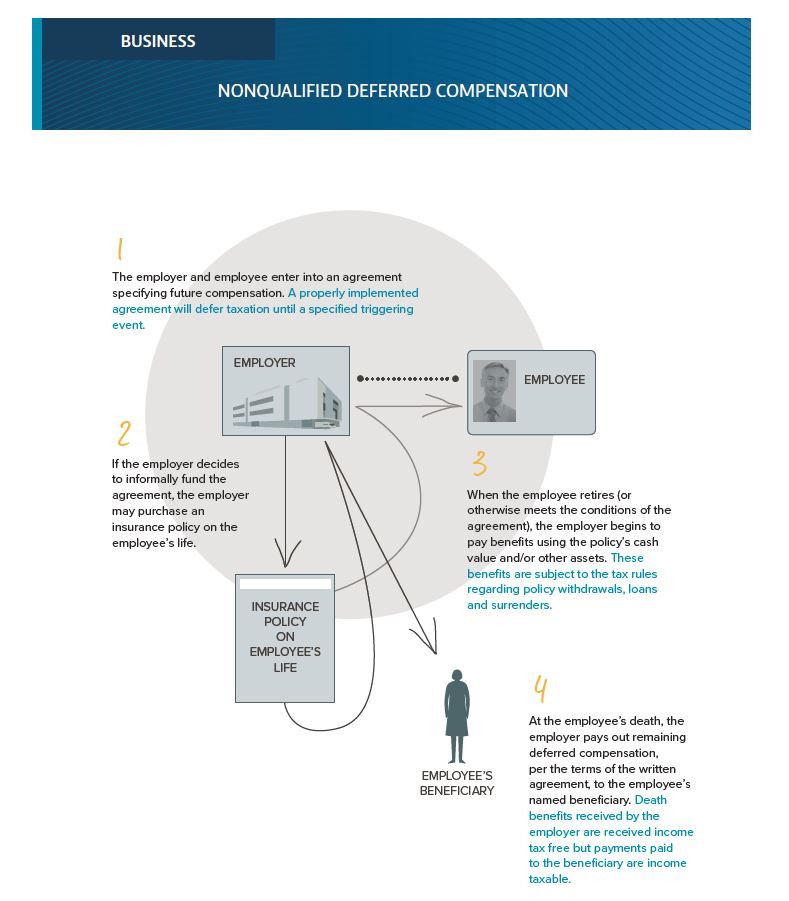

Non-Qualified Deferred Compensation

Among the business leaders surveyed 82% stated that Non-Qualified Deferred Compensation Plans (NQDCPs) have a high or moderate impact on their overall plan success. Because an NQDC plan isn't required to comply with the rules that govern qualified plans, it offers a flexible form of supplemental compensation that allows a business to customize the structure of the plan to suit its needs. NQDCPs that are funded wholly or in large part by life insurance often work like this:

- The executive and the business agree to an arrangement that defers compensation, and provides for future compensation at retirement. A life insurance policy on the executive's life is purchased by the business, with the business as beneficiary.

- If the executive dies before retirement, the life insurance benefit that is paid to the business can be used for survivor income benefits and/or key person benefits.

- When the executive retires the business uses the best current tax-efficient options to access the policy's cash values, providing a stream of retirement income to the executive.

- At the executive's post-retirement death, the business can pay out and/or retain part or all of the remaining death benefit, depending on the terms of the NQDC agreement. Plans can opt to retain the remaining death benefit as a form of long-term cost recovery.

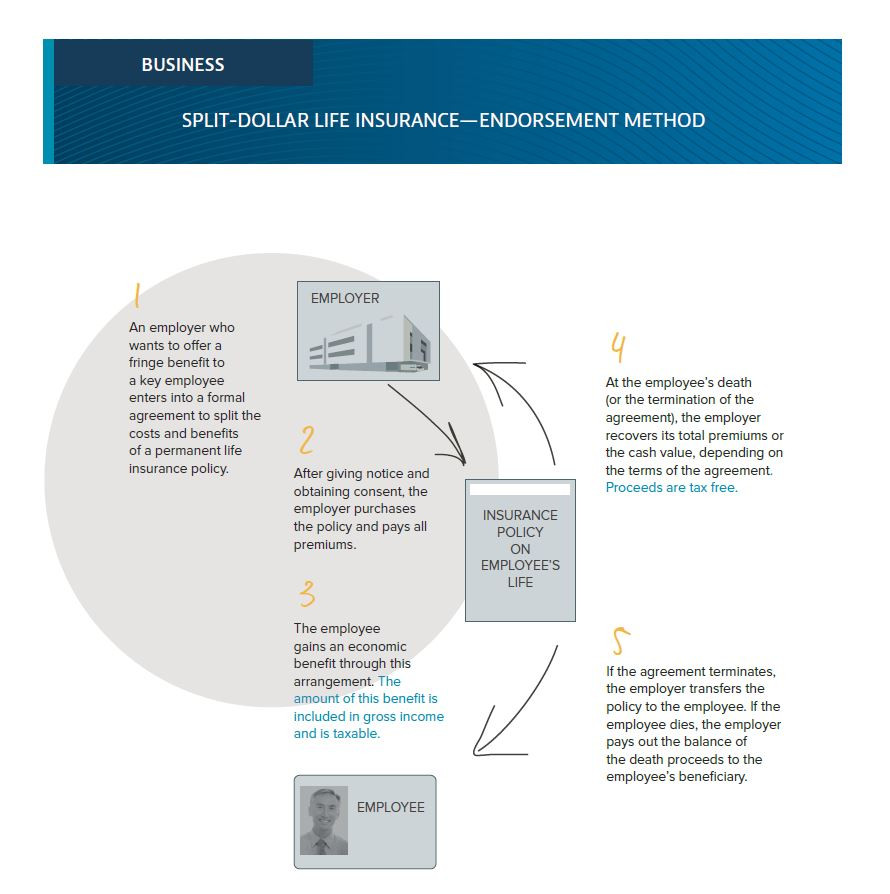

Split Dollar

NFP's survey indicates that 32% of business leaders offered Split Dollar plans as an executive benefit, and that an impressive 72% considered Split Dollar to have a high or moderate impact on their overall plan success. Split Dollar is a literal splitting of life insurance policy benefits and, in some cases, premium payments between a business and an executive. Split Dollar is relatively simple and cost-effective to implement, and provides a valuable benefit for executive incentive and retention that helps an executive buy substantial amounts of life insurance at an affordable cost. Here is how one variation on an endorsement-style Split Dollar arrangement would work:

- A business and executive agree to split the costs and benefits of a permanent cash value insurance policy.

- The business purchases and pays premiums on the policy.

- The executive receives a relatively modest taxable economic benefit, based on annual renewable term insurance rates.

- If the executive dies during the arrangement, the business is entitled to recover its premium costs. The remaining death benefit is paid to the executive's beneficiary.

- The Split Dollar arrangement can be terminated with the agreement of both parties. The business transfers policy ownership to the executive. The transfer is taxable, and the tax liability can be mitigated through a bonus or other means of compensation.

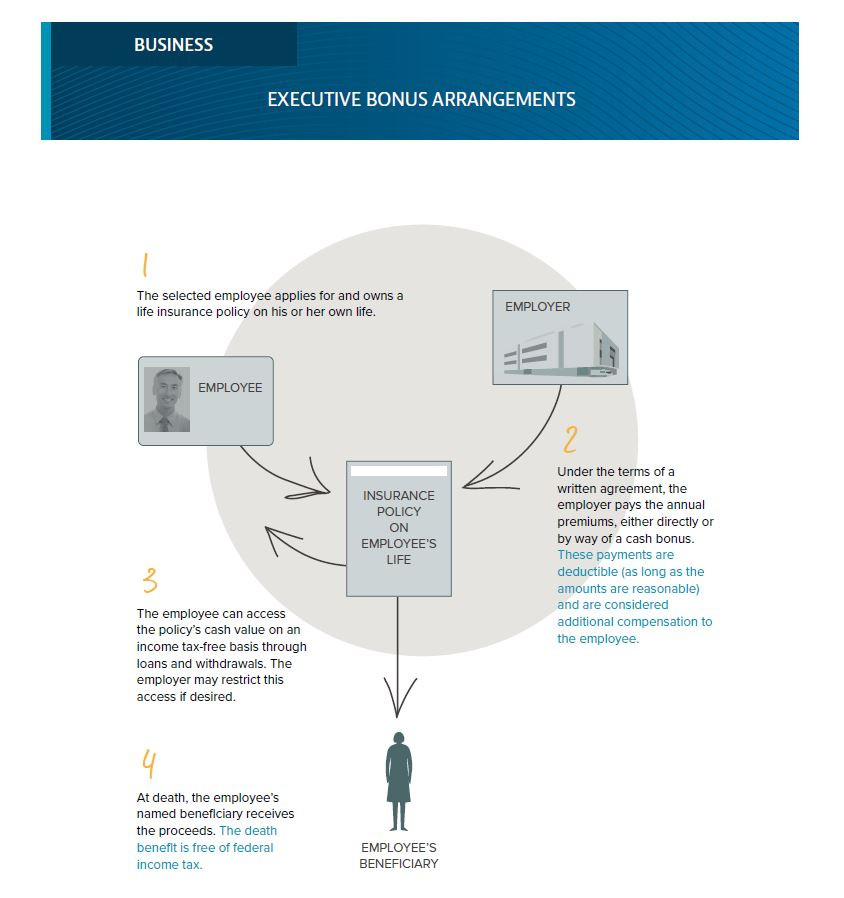

Supplemental Executive Life Insurance

Supplemental Executive Life Insurance is offered by 40% of business leaders in NFP's survey, and viewed by 59% as a high or moderate impact benefit. From section 79 Group Life Insurance, to Executive Carveout plans, to highly compensated Executive Bonus plans, there is both variety and flexibility in the ways that businesses can use life insurance as a benefit to attract and retain the best talent. Windsor has recently promoted several Executive Carveout plans from highly-rated carriers that specialize in this market, and you will find links to some of their materials at the end of this Blog. Below, a quick review of a simple but highly effective Executive Bonus Plan:

- The business and executive formally agree that the business will provide supplemental compensation for the executive to purchase and own a personal life insurance policy.

- The business pays the annual premiums via a cash bonus.

- Payments are deductible under Section 162 as ordinary and reasonable compensation. Payments are taxable to the executive, but this tax can be covered with an additional bonus.

- The executive has full ownership rights to the policy, with no obligation for repayment to the business.

- The death benefit is paid to the executive's designated beneficiary.

What You Can Do

The demand for executive talent with specific skills is on the rise in the US, but the supply is not keeping up, leading to a talent gap that organizations must address through creative recruitment strategies and management practices. Business leaders from all sectors recognize that compensation alone is not sufficient to recruit, reward and retain the talent they need to prosper. NFP's survey demonstrates that plans that include life insurance are viewed by both business leaders and executives as highly valuable benefits that significantly impact a plan's appeal and performance. As a financial services professional, you are ideally positioned to bring these solutions to your clients, prospects, and centers of influence. And Windsor, as always, is here to help you succeed.

Comments