The Inflation Conversation

— Your clients are worried. Life insurance can help.

"The actor Paul Picerni was my grandfather," begins Windsor's Dan Picerni. "I called him Papa. He appeared in over five-hundred films and television productions. With eight kids he couldn't afford not to work when the downtimes came, so he filled the lull by selling life insurance. In the 1950s he bought three nice size life insurance policies to help take care of his family in the event of his death. Fortunately, the income replacement was never needed, and he lived until 2012. He continued paying the monthly premiums for all those decades. In the end he had a total of $30,000 in life insurance. But the purchasing power of his policies had been eaten away by inflation.

"Telly Savalas, the star of the TV series Kojak, was one of my Papa's close friends. He and Telly often traveled to Las Vegas. As a kid I remember seeing Telly at my grandparents' home many times. My Papa sold Telly a million dollar life insurance policy in the mid-seventies, which was at the height of Telly's success with the popular Kojak series. By the time of Telly's passing in 1994, some twenty years later, the purchasing power of that policy had decreased to an inflation-adjusted $330,000 worth of goods and services. For both my grandfather and Telly, the real value of the life insurance that they had acquired to provide financial security for their survivors and families had been eroded over time to a fraction of what they had hoped to leave behind."

Dan's story is unique, but not uncommon. A LIMRA study from 2021 listed the three top reasons that people buy life insurance:

- To cover burial and final expenses (83%)

- To help replace the income of a wage earner (68%)

- To transfer wealth or leave an inheritance (63%)

Life insurance is specially positioned to accomplish all of these goals, and more. The majority of these policies are acquired to provide financial security to survivors at some time in the unknown and probably distant future. But recent increases in the rate of inflation in the US and abroad bring us to an important question: How can you, as a financial planning professional, help your clients to cushion the effect of inflation on the value of their life insurance plans? Especially when the purpose of the insurance is to provide for an event that, in the minds and intentions of insureds and beneficiaries, is only likely to happen many years, or decades, from today?

. The Trouble with Inflation

Inflation is a general increase in the prices of goods and services. When the general price level rises, each unit of currency (in the U.S., usually expressed in dollars) buys fewer goods and services. Inflation measures how prices for goods and services increase over time. But purchasing power looks at the flip side — how much can a single unit of currency buy? A small amount of inflation is generally regarded by economists as a sign of a healthy economy. But when inflation rises sharply and remains higher than normal, economists start to worry.

The year-over-year annual inflation rate in the US was 9.1% in June 2022, the largest increase in 40 years. Hit hardest have been the costs of fuel and fuel-related sectors, such as energy, utilities and transportation. But also noticeably affected were household food and supplies, medical care services, and motor vehicle parts and equipment. Government agencies are of course initiating measures in an attempt to tame the inflation rate – the most noteworthy being the increase in interest rates promulgated by the US Federal Reserve. Such measures have often been successful over relatively short periods of time. But not always.

Over the past 50 years, the longest continuous duration with an annual inflation rate over 5% - measured by the CPI - was 1973-1982, aggravated in large part by supply shortages and surges in oil prices in the US. To give you an idea of what that kind of inflation translates into in terms of reduced purchasing power, to buy the goods and services that $1,000,000 would have bought in 1972, you would have needed $2,460,950 in 1983. Looked at another way, the chart below shows what $500,000 would be worth at the end of several durations and at various sustained rates of inflation.

We all hope never to see that kind of sustained inflation again. But life insurance is purchased in large part to provide peace of mind — the knowledge that in the case of an untimely death the financial needs of the survivors will be secure. What can you do to help preserve that peace of mind when the shadow of inflation is front and center today among your clients' concerns?

Life Insurance Product Solutions to Help Fight Inflation

Permanent life insurance has several options that can address the impact of inflation over time by increasing the death benefit of the policy. These options don't directly track inflation, CPI or some other proxy for inflation, but they do provide a hedge against the impacts to purchasing power over time. Most permanent universal life policies offer increasing death benefit options such as Return of Account Value (DB option 2 or B) and Return of Premium (DB option 3 or C). For example, if the account value (cash value) of the policy compounds at 3% over 30 years and inflation averages around the same rate, the increased death benefit will maintain roughly the same purchasing power. Whole life can have a similar result through Paid-Up Additions which use annual dividends to buy additional amounts of death benefit.

One life insurance company, Lincoln National, recently added a new increasing death benefit rider to their Survivorship IUL that increases the death benefit by a fixed 3% per year to a maximum of twice the amount of the initial death benefit.

Some companies offer term insurance with a "return of premium" death benefit rider, however the premium for term insurance is comparatively low and would not represent a meaningful inflation hedge. The better approach with term is to purchase additional coverage from day one to reflect the reduction of purchasing power over time. For example, to preserve at least $1,000,000 of purchasing power over a 15 year level term duration assuming an inflation rate of 3%, a 45 year old female would acquire a policy with an initial face amount of approximately $1,500,000. For a preferred non-tobacco client, that additional premium would be about $25.00 a month, a measure of security well worth the extra expense.

Professional Service Solutions to Help Fight Inflation

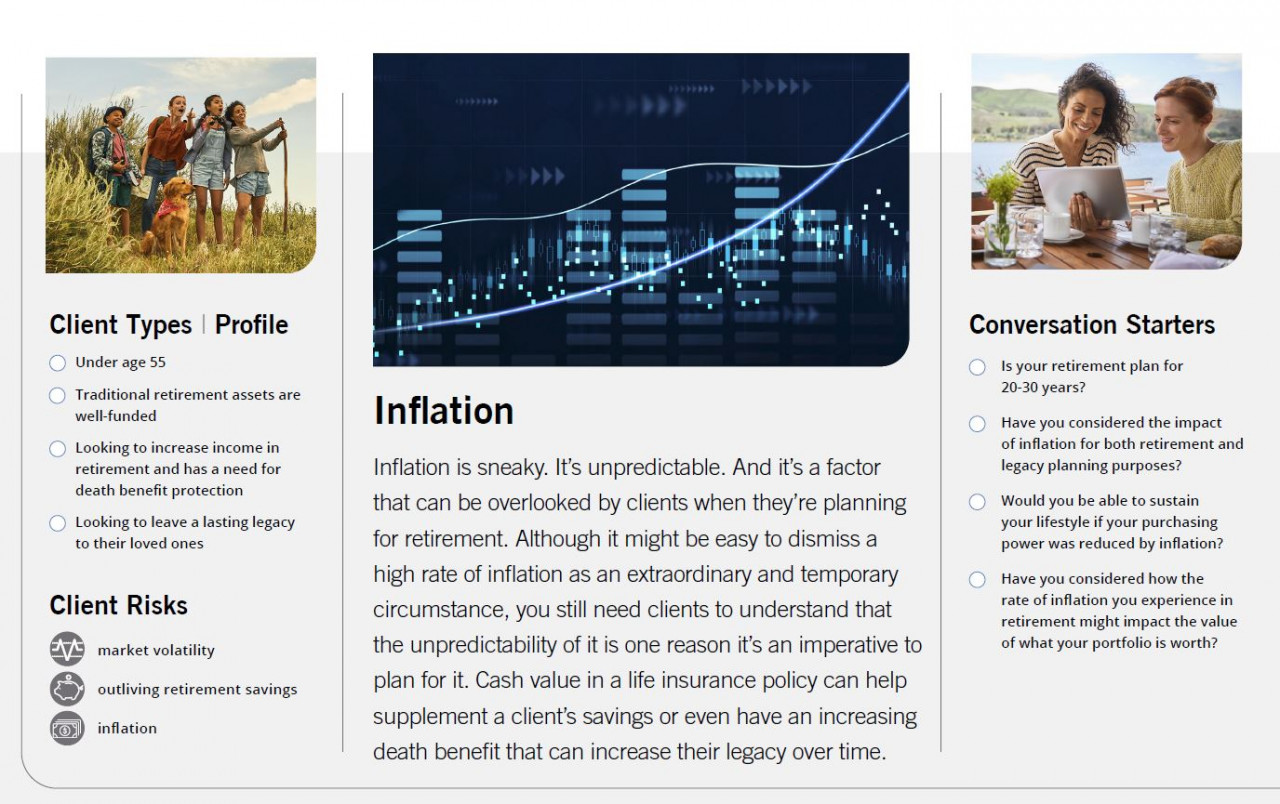

In times of inflation, staying connected with clients is no longer just recommended, it's absolutely mandatory for your ongoing success and the survival of your practice. Retaining clients, finding new ones, and cultivating referral sources depends on your firm's ongoing service capabilities and ability to keep clients well informed and their plans on track. Below is a snapshot of one typical client, courtesy of Prudential.

Many resources like this are available to bring the problem of inflation to your clients' attention. And here are some suggestions for other steps you can take to provide your clients with the confidence and security they seek:

- An in-depth annual review that includes recommended adjustments in the client's insurance and asset mix to offset any inflationary deterioration of purchasing power.

- NIC – Network Insured Connect. A Windsor partner that provides an industry wide, multi-carrier inforce policy management platform that connects agents, distributors, carriers and policy owners enabling digital relationships between all parties. NIC for Agents offers a single platform that provides access and insights into your book of business with In Force data from multiple carriers and distributors. Instantly view profiles of policy owners and your current book of business, along with data insights and policy documents.

- Veralytic. A tool to help you monitor the performance of existing coverage relative to the market. The Veralytic Report is the only patented, objective and transparent evaluation of suitability for life insurance policies.

All of this gives you the ability to monitor, measure and adjust your client's life insurance portfolio to ensure it continues to meet both their needs and expectations. Communication and transparency are the critical components needed to make appropriate revisions so that a sufficient combination of assets and death benefit meets your client's goals at that unexpected time. With an array of product solutions and extensive service resources readily available, now is the time to have that essential "inflation conversation" with your clients.

Comments