Hepatitis C - An Underwriting Niche with Tremendous Sales Possibilities!

Historically, there have been very few underwriting niches that truly provided expansive new sales opportunities. Life insurance companies have sometimes, often accidentally, discovered market segments that were being assessed based on outdated actuarial data or medical information, and tried to target those segments with more aggressive underwriting offers. But mostly, when I have come across various intriguing niches over the years, many are too narrow in scope and not all that significant in terms of the potential market size.

But recently, I discovered what I think is an exception. Hepatitis C.

The Hepatitis C segment interested me for two key reasons. First, the large population of potential insureds who may benefit from it; and second, the possibility of a preferred offer if circumstances are right.

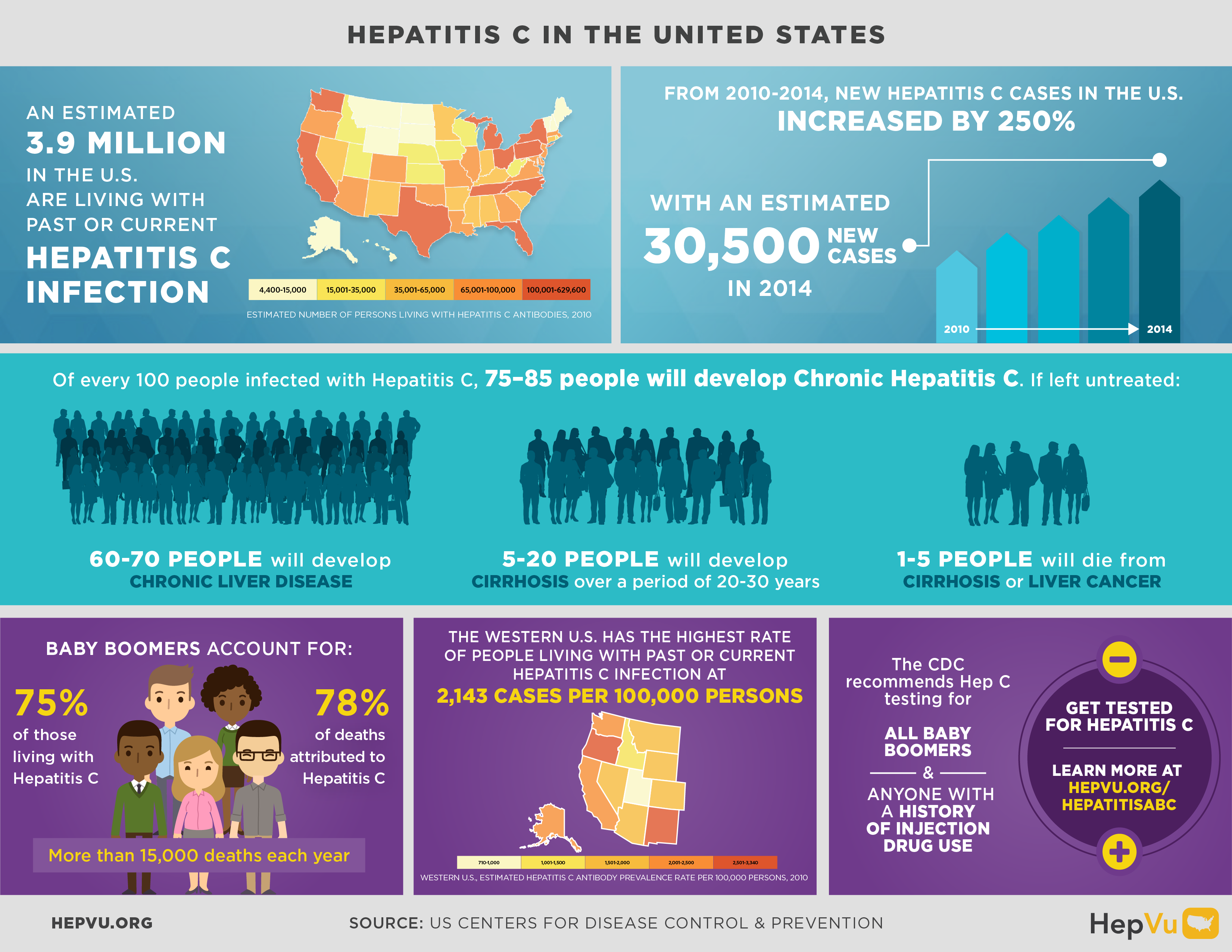

According to the Center for Disease Control, there are up to 3.9 million people in the United States afflicted with Hepatitis C. The prevalence of this malady is greatest in the baby boom generation, or those born between 1945 and 1960. These folks are typically in their prime earning and wealth years. A very big and potentially very lucrative market.

However, "new generation" drugs - Direct Acting Antivirals (DAAs) - were introduced within the past few years offering an entirely more favorable outlook on this condition.These drugs offer a shorter treatment time (8 to 12 weeks), a smaller number of side effects, and a much better response to treatment—boasting a cure in over 85% of cases.

One life insurance company, Lincoln Financial, took these developments and crafted a forward-thinking set of underwriting guidelines to go after this market. They now may offer up to preferred class if the applicant has:

- Been treated with DAAs for 8 to 12 weeks or with interferon plus ribavirin for 24 weeks, AND Hepatitis C RNA/PCR is negative (Hepatitis C virus is cleared) 12 weeks after treatment

- No worse than mild liver fibrosis (METAVIR score F0 to F1)

- Normal post treatment liver enzymes

- Favorable medical follow up

Windsor has already realized the benefit of this exceptional niche. One of our cases started out a few years ago with initial carrier responses of "Decline" due to untreated Hepatitis C. The offers were subsequently reconsidered a few years later and improved to "Table 4" after the applicant sought treatment. And just recently, we took another shot at securing coverage on a more favorable basis and Lincoln approved $6 million of coverage at preferred! This is an incredible win for Windsor, the agent and the client.

You can easily see the extraordinary opportunity available to you today in this substantial and accessible market segment. We recommend that you review prior applications and your existing book of business to see if we can help improve past Hepatitis C offers. Both you and your client will be glad you did.

At Windsor, we keep our finger on the pulse of underwriting to bring you the best the industry has to offer. Come to us for any of your underwriting or other needs for help!

*Infographic courtesy of HepVu (www.hepvu.org). Emory University, Rollins School of Public Health.

Comments