THE FOREIGN NATIONAL MARKET: A TREMENDOUS POST COVID SALES OPPORTUNITY

DuWayne Kilbo, MBA, FLMI, Senior Vice President and Chief Underwriter, Windsor Insurance Associates, Inc.

Cindy Davis, FALU, FLMI, ACS, Vice President, Senior Underwriting Consultant, Underwriting/International NFP

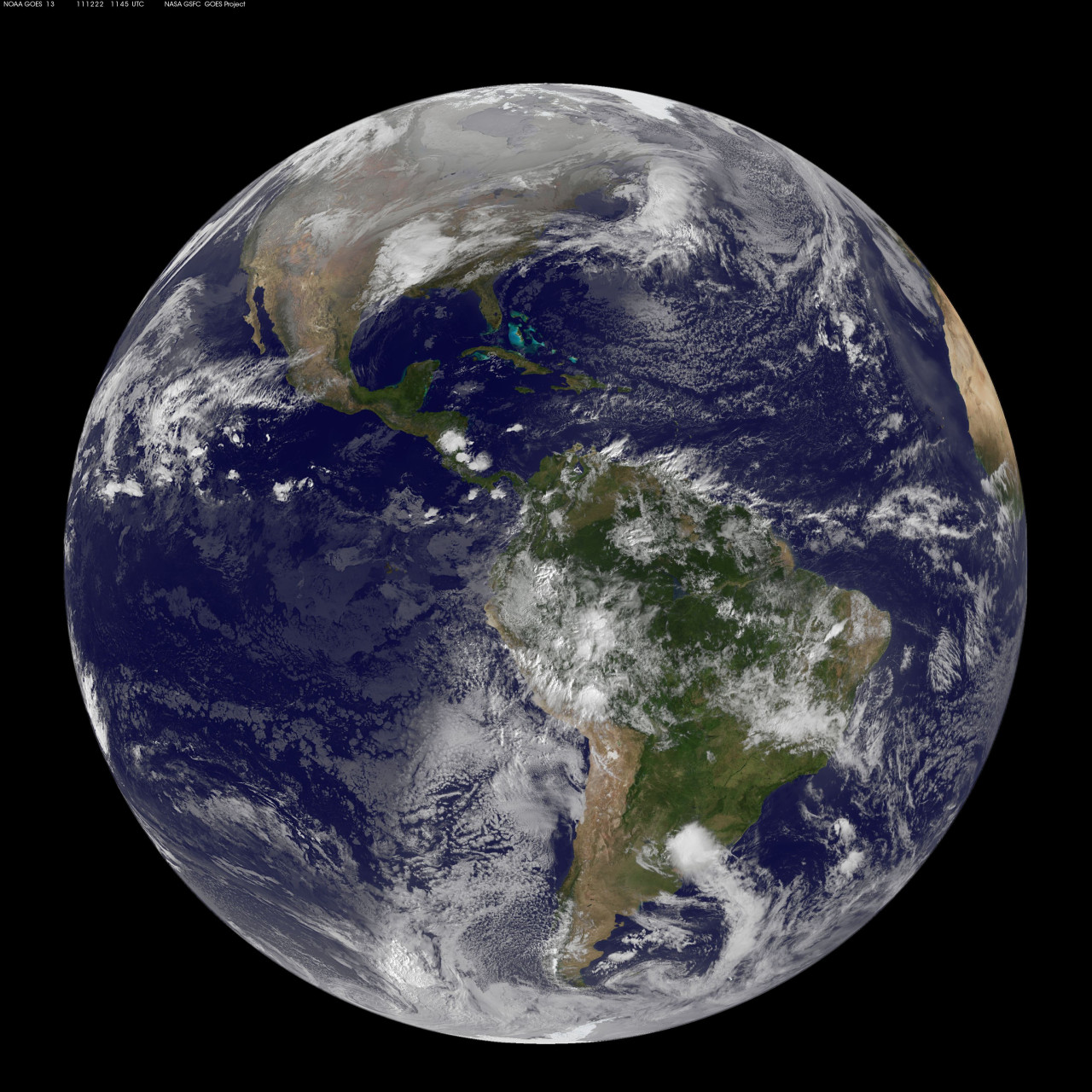

High net worth individuals and families exist all over the world. In today's global economy, you probably have clients with friends or relatives living abroad who are looking to buy life insurance from U.S. based companies.This is especially true since COVID has subsided, and countries have opened their borders to allow travel. COVID lockdowns created a pent-up demand for life insurance, and the overall financial stability of U.S. life insurance companies makes their products more sought after by foreign residents.

Whether for business planning, wealth transfer, legacy planning, wealth accumulation or family protection, many foreign nationals are motivated by having monies outside their country of residence. They desire the stability of U.S. dollar-denominated coverage, asset diversification and protection against any governmental changes or mandates that can negatively impact personal income and net worth.

In addition, U.S. based insurance coverage provides recognizable carrier brand names, more product choices and options, better pricing, underwriting capacity to handle the largest cases, and U.S. dollar liquidity via policy withdrawals or payment at time of death.

Selling in the foreign national market can be very rewarding, yet challenging. There are many atypical factors to be aware of which can enhance or become roadblocks to an otherwise profitable sale.

It is critical to have a working understanding of regulations pertaining to foreign nationals, and to develop knowledge of unique carrier guidelines and rules when considering doing business in this market. And equally important is having a firm grasp on case design for what different prospective foreign nationals find attractive for plans of coverage and funding patterns—and why.

We recently placed sizeable target premium policies on the lives of several foreign nationals. Two individuals were seeking coverage for the dual purpose of death benefit protection and cash accumulation. Another was primarily seeking cash accumulation, while the final insureds were looking for death benefit protection and cash accumulation provided by variable survivor life coverage.

Index Universal Life (IUL) is often the product of choice for many foreign national sales. However, Variable Universal Life is also occasionally used. For IUL plans, funding is typically on a short-pay basis, anywhere between 5 and 10 years, to develop cash values quickly and provide liquidity outside the foreign national's home country:

1. 55 year old male, Mexican national, $20 million Death Benefit IUL, target premium $350,000

2. 50 year old male, Chinese national, $10 million Death Benefit IUL, target premium $150,000

3. 45 year old male, Brazilian national, $7.5 million Death Benefit IUL, target premium $100,000

4. 37 year old male U.S. citizen, 35 year old female Israeli, residents of Israel, $3 million Death Benefit SVUL, target premium $14,000

You may have thought about entering the foreign national market and perhaps even dabbled in this market in the past. If you have, now is the time to make a major push to uncover sales opportunities. Why? Besides market demand created by COVID, carriers in their quest for new and additional sources of revenue have increased their appetites for foreign nationals and relaxed rules, making it easier for applicants to qualify for coverage.

For example, we've seen some liberalization in nexus and power of attorney for policy delivery — traditional stumbling blocks when writing this type of business. Several carriers are active in the foreign national market, with John Hancock, Lincoln Financial, Pacific Life, Prudential and Symetra being noteworthy for their progressive guidelines and rules.

UNDERWRITING IMPROVEMENTS

Nexus

Traditionally one of the major roadblocks to uncovering and completing a sale, nexus is the physical and financial connection an applicant has to the U.S. Many carriers require minimal annual stays, such as 15 days, in the U.S. And they typically require some type of financial presence such as a U.S. bank account or brokerage account with a minimum balance, along with other connections such as U.S. real estate or business ownership.

We've seen recent and welcome nexus liberalization with certain carriers that will help considerably. For example, requiring a physical U.S. connection has been loosened with some carriers to just a few days or less in the past few years. Some carriers even consider having a full time college student in the U.S. as nexus for a parent desiring coverage.

Also, the requirement of U.S. financial presence has been greatly reduced. In some cases, having $100,000 in a "seasoned" U.S. bank account after paying premiums will satisfy underwriting. And with certain carriers in some situations the required amount may be considerably less.

It is also important to point out that while we are seeing liberalized nexus requirements, the vast majority of carriers still require a U.S. mailing address for billing and policy correspondence.

Power of Attorney for Policy Delivery

Carriers typically require all solicitation as well as application and insurance exam paperwork to be completed in the U.S., because domestic carriers are often not licensed to conduct business outside the U.S. But what happens at policy delivery when an insured may no longer be in the U.S. to accept coverage?

If an insured is not the owner of their policy, most carriers require a U.S. based owner such as a trust or business. For these latter ownership arrangements an expanding number of carriers provide a limited power of attorney which allows coverage to be accepted on behalf of an insured. This assumes no health statements or other amendments are needed that require an insured signature. This is a welcome change to a step fraught with potential delays.

Acceptable Countries

The list of acceptable countries has expanded. Colombia, Vietnam, Qatar, all major cities of China, and several others are showing up on approved carrier lists.

Some of these are "A" countries, with mortality similar to the U.S. and are allowed best rates. And some are "B" countries that provide less than best rate classes. However, the fact that there is an expanding list of countries is positive. It's typically worth a call to find out if a citizen of a foreign country is writable for coverage and on what basis.

Premium Finance

Several carriers will now consider premium financing arrangements for foreign nationals. There may be certain rules and guidelines such as minimum net worth (for example, $10 million), minimum earned income ($250,000) and ongoing payment of interest. However, being able to finance premiums is a real advantage, providing an alternative way to pay for premiums which in many cases can be quite expensive.

Capacity

CASE DESIGN TIPS

Below are case design models we have successfully used when considering coverage for applicants in three different foreign national markets. They demonstrate differences in what various foreign national applicants consider their highest priorities, and provide guidance as you come across various sales opportunities.

Chinese Nationals

The objectives of many Chinese Nationals are to diversify investments, accumulate cash, create an alternate source of income outside China and provide death benefit protection to heirs in case of death. Since there is no estate tax in China, coverage is not includable in one's estate upon death for tax purposes. A benefit of this is that policies are often owned by the insured to provide policy level control and decision-making autonomy. Also, since there is no reporting to the Chinese government, life insurance is attractive for the privacy it affords.

Case design commonly includes:

Short pay premium patterns, ranging from 5 to 10 years. Short pay is often preferred by applicants to quickly move large sums of money outside the political and economic environment of China, and for funds to be put to work immediately.

Index universal life (IUL) plan of coverage, with the ability to provide cash accumulation and death benefit protection.

Income withdrawals may be included, depending upon the needs and goals of the applicant.

Mexican Nationals

There is no estate tax in Mexico, so the objectives of many Mexican Nationals, like Chinese Nationals, are to diversify investments, accumulate cash, create an alternate source of income outside Mexico and provide death benefit protection in case of death. In addition, there is a strong desire for the stability of a U.S. dollar-denominated policy. However, even without an estate tax, there are death benefit sale possibilities for various individual or family planning objectives. Often polices are trust owned, but there is also individual ownership in order to provide policy level control and decision-making autonomy for purposes such as beneficiary changes and policy withdrawals.

Case design commonly includes:

If cash accumulation and death benefit are desired:

IUL product chassis

Short pay premium patterns, ranging from 5 to 10 years

Reasonable death benefit

Withdrawals starting at a projected age and extending for a period of years

If death benefit is desired:

Guaranteed UL (GUL), current assumption UL (CAUL) or IUL single life or last survivor product chassis

Coverage is modeled to last anywhere from life expectancy to life time

Premium funding pattern dependent upon client preference

Japanese Nationals

The estate tax in Japan is very onerous, consuming up to 55% of an estate at the highest levels. Death benefit is often the primary objective for many Japanese nationals. Often polices are trust or LLC owned.

Case design commonly includes:

Single life plans of coverage

GUL or IUL product chassis

Death benefit guaranteed for life time

Premium funding pattern dependent upon client preference

The specific design scenarios previously described aren't necessarily unique to the countries above. You will find these same recurrent themes to be present with applicants of other foreign markets. Much depends upon the client's need to diversify, need to accumulate monies outside their country of residence, level of "in country" taxation and other variables mentioned earlier.

In addition, it is critical to gain a thorough understanding of carrier guidelines and rules when considering doing business in this market. Combining this knowledge with case design will help ensure a successful and prosperous outcome.

We work in the foreign national market every day, successfully steering cases through the often complex process of products, carriers, underwriting and placement. Bring us your next foreign national case and let us do the rest — we will be glad to help you expand your sales success.

Comments