Windsor, Life Happens and AIG Get Together for a Webinar You Don't Want to Miss! On Demand Now!In today's social-distancing reality, staying connected and maintaining your trusted relationship with clients and centers of influence is more important than ever. But where can you find relevant content that is easy to use? Windsor invites you to learn about the resources, marketing tools and competitive advantages offered by Life Happens and AIG that are literally at your fingertips, along with social media best practices that you can implement today!

Driven by new CSO tables and Principle Based Reserving (PBR), year-end 2019 ushered in a host of life insurance product changes. These changes impacted both a substantial number and a broad diversity of life insurance products and pricing — especially death benefit-oriented "permanent" plans of coverage, a market where many of us spend considerable time promoting and selling. To assess what happened, we completed a survey of this market based upon the carriers Windsor represents. While many of our observations were similar for single and joint life products, there were notab...

No matter where you live, no matter where you do business, if you actively participate in the recommendation or sale of a life insurance or annuity product to a client in New York, Rule 187 directly applies to you. And if it doesn't apply to you today, probably all you have to do is wait. Because, when it comes to insurance regulation, what happens in New York never stays in New York. Although Rule 187, the new Suitability and Best Interests in Life Insurance and Annuity Transactions rule, exclusively applies to insurance and annuity sales in New York, we have seen regulations like...

In November of 1960 the season was more than half over when the 6-1 Philadelphia Eagles met the 5-1-1 New York Giants with first place on the line in the NFL's Eastern Division. The Giants jumped out to a 10-0 first half lead, but the Eagles fought back to take a 17-10 advantage late in the fourth quarter. The Giants were driving toward a tying score when Frank Gifford, their All-Pro halfback, ran a quick slant pattern across the middle. He caught the ball, but was knocked off his feet by Chuck Bednarik, a 6-foot-3, 235-pound outside linebacker, coming from the opposite direction. The 6-foot-1...

We're pleased to have Colin Devine, of C. Devine and Associates, join us today for a very timely and important Windsor blog about a topic that could have a significant impact upon the type and price of the products you'll be selling in the not too distant future. Colin, in August, 2018, the Financial Accounting Standards Board issued Accounting Update 2018-12 (ASU 2018-12), an update that affects all insurance entities that issue long-duration contracts – including life insurance and annuities. Earlier this year, C. Devine and Associates published an exhaustive industry peer review on the impl...

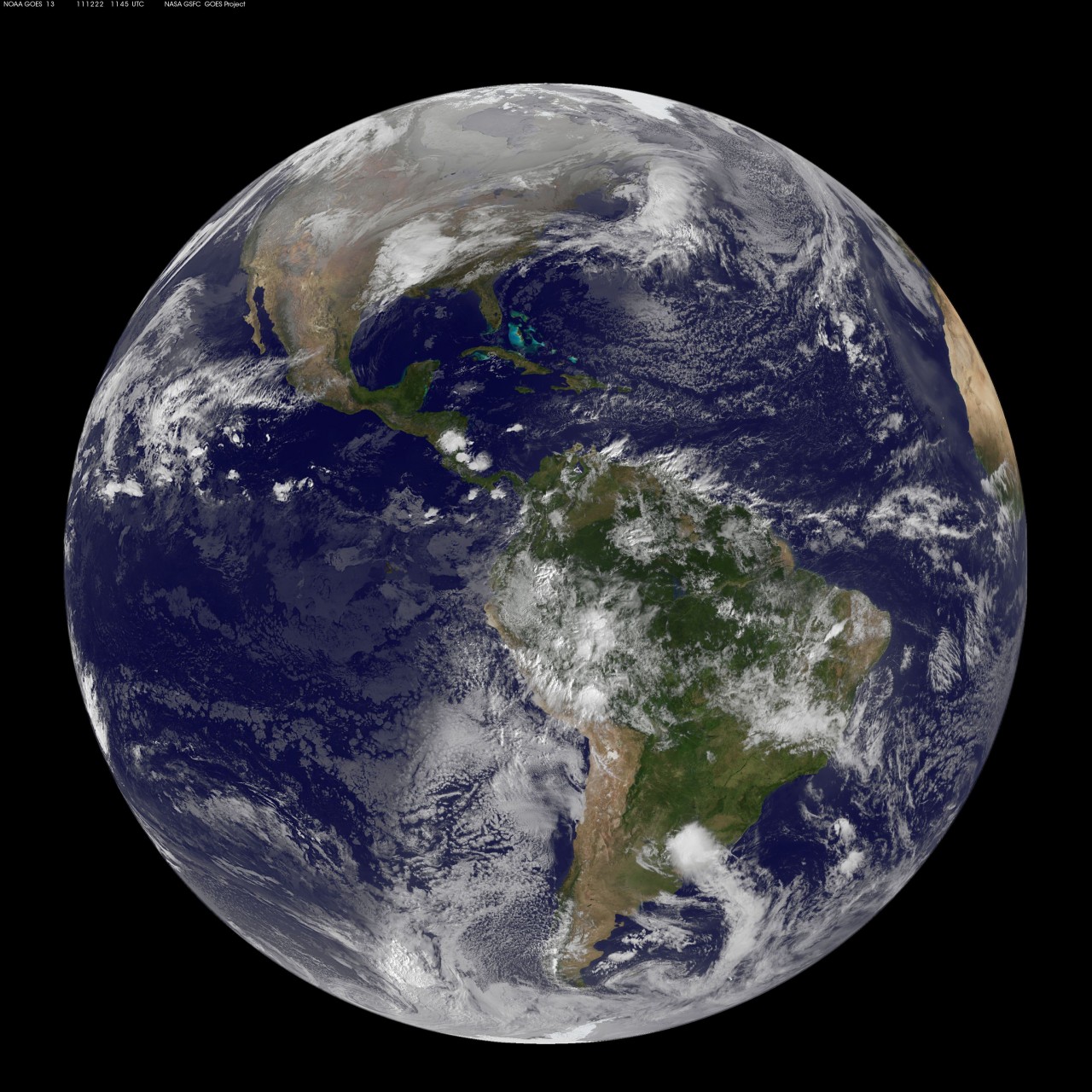

"I haven't been everywhere, but it's on my list" - Susan Sontag High net worth individuals and families exist all over the world. In today's global economy, you probably have clients with friends or relatives living abroad who are looking to buy life insurance from U.S. based companies. Whether for business planning, wealth transfer, legacy planning, wealth accumulation or family protection, many foreign nationals are motivated by having monies outside their country of residence. They desire the stability of US dollar denominated coverage, asset diversification and protection again...

A successful sale typically has three common elements: It solves a large problem. The solution itself is time-limited, meaning that if you don't take action soon, all will be lost. And it's a story that you can honestly get passionate about because it's so important to the client. The Tax Cuts and Jobs Act of 2017 created that exact scenario. Beginning in 2018 and lasting through 2025, the U.S. has dramatically increased the amount of money/assets that individuals can gift to non-charitable entities without being subject to federal gift taxes. Any client who had m...

It's always great catching up with industry technical guru and thought leader, Bobby Samuelson. Bobby's Life Product Review is the only source for independent, objective and technical life insurance product intelligence and an outstanding resource for all of us in this industry. We asked Bobby if he would like to join Windsor's Marc Schwartz in a conversation about the latest developments in Index Universal Life products, and Bobby graciously accepted. Marc Schwartz, Windsor Insurance: Bobby, we really appreciate you taking the time to educate us on what's happening in the wo...

Algorithmic and Predictive (aka Accelerated) Underwriting Hits a Speed Bump in New York In January of this year, the New York Department of Financial Services (DFS) issued an Insurance Circular Letter on the Use of External Consumer Data and Information Sources in Underwriting for Life Insurance. According to the DFS, the purpose of the Letter was "to advise insurers authorized to write life insurance in New York of their statutory obligations regarding the use of external data and information sources in underwriting for life insurance." While on the surface this seems like a rath...

The popularity of Index Universal Life products has stirred up the creative talents of many professional financial advisors, and nowhere has that creativity been more apparent than in the area of policy loan rescues. No question this is a significant opportunity to bring value to clients and generate a new sale, but it requires a high degree of expertise to navigate successfully. This article will review rescue strategies so that you have a better idea of what works and what doesn't. In addition, the Windsor case design team is fully conversant on the options and approaches t...