A New Look at Limited Payment Whole Life Insurance Contracts

Early in 2022, Windsor began to see a new growing focus on cash accumulation sales. While using life insurance to provide funds for future cash flow obligations, be it college tuition or supplemental retirement income, is nothing new, something had changed.

In 2020, in an "under the radar" rule change, the §7702 interest rate — which sets limits on premiums, cash values and death benefits for life insurance policies to qualify as "life insurance contracts" for Federal income tax purposes — was revised. The rates, which were last set in 1984, were 4% for the Cash Value Accumulation Test (CVAT) and 6% for the Guideline Premium Test. Effective for policies issued after Dec. 31, 2020, the fixed 4% and 6% minimum annual effective rates under these tests were changed to refer instead to a market-based rate called the "Insurance Interest Rate".

For contracts issued in 2021, the Insurance Interest Rate was set at 2%. After 2021, the rates will be subject to change in adjustment years which typically occur every 8 to 9 years, with the rate change itself based upon a pre-established benchmark rate.

By reducing the §7702 rate, policies could accept more premium for every dollar of death benefit while still staying within the legal definition of a "life insurance contract." Staying within that definition means cash distributions from the policy will be treated as return of basis first and therefore not taxable, and policy loans will not be taxable unless the policy is surrendered or lapses. If the policy violates that definition, a life insurance contract becomes a Modified Endowment Contract (MEC), and cash distributions, including loans, become taxable to the extent of any gain in the contract, and an additional 10% penalty applies to all taxable distributions pre -age 59 1/2. NOT A GOOD THING.

Allowing consumers to put in more premium for every dollar of death benefit gives carriers a reason to really start pushing, once again, the notion that life insurance is not just about death benefit. This blog specifically discusses limited pay whole life policies and how they can be used to fund future cash flow needs, but also considers what advisors should be aware of as they review these products for clients. In a follow up blog, we can explore how this has impacted other types of insurance products. First, let's start with some whole life basics.

The Basics

The Guarantees - Participating whole life insurance is one of the oldest types of permanent insurance sold. Participating means that the insurance is sold by companies that are owned by their policyholders and company profits are returned to the policyholders in the form of dividends. Whole life premiums are guaranteed. Premiums are contractually due and payable for a period that is established at policy inception. Common payment periods are 10 years, 20 years, to age 65, to age 100 or to an extended maturity (typically age 120).

Some carriers design separate products to handle these various payment periods while some have one product that can handle different payment durations. Contractual premium periods should not be confused with shortened payment periods where premiums are paid by policy dividends (premium offsets). In addition to the premium guarantee there is a policy cash value that is guaranteed that grows over time and a guaranteed level death benefit.

Dividends - Whole life insurance is like a four-legged stool, built with guaranteed premiums, guaranteed cash value, guaranteed death benefit and policy dividends. Of the four legs, only dividends are not guaranteed. They are determined each year based on a company's expenses, mortality experience and investment performance which sets what is referred to as the dividend crediting rate. Every carrier publishes the total amount of dividends paid in any given year as well as their dividend crediting rate.

Whole life policyholders can choose a variety of dividend options that are intended to either reduce the premium, pay the premium in the future, or if cash value is the priority, used to increase the policy cash values and death benefit. When used to enhance cash value and death benefit, the dividends purchase what are called paid-up additions which can be considered mini paid-up policies that have their own guaranteed cash values and death benefit and generate their own dividends.

Policy Cash Value - Whole life contracts can have two separate pools of funds that can be accessed by policyowners. One pool is created when a policyholder elects paid-up additions as their dividend option. Those funds can be either surrendered or borrowed as needed. To the extent they are surrendered, if the surrender amount is less than the policy basis, the surrenders will not be taxable. The other pool which makes up the guaranteed cash value can only be borrowed and if the outstanding loans are repaid with tax-free death benefit proceeds (policy not surrendered with a loan outstanding), the borrowed funds will not be taxable. When a whole life policy endows, the guaranteed cash value equals the guaranteed death benefit.

Policy Loans – The cash value that is generated in a whole life policy is only good if those dollars can be accessed by the policy owner in a cost-effective manner. How a carrier sets its current and future policy loan rate is a factor in that calculation. In addition, carriers have different rules regarding how policy loans impact their dividend crediting rate. Policy loans from a carrier with direct recognition of policy loans will impact a policy's dividend crediting rate to take into account the specific policy's outstanding policy loan. A carrier with non-recognition policy loans has a dividend scale that is adjusted in the aggregate for all policy loans outstanding at the carrier and the dividend crediting rate remains constant for all the policyowners even when a specific policy has a loan outstanding.

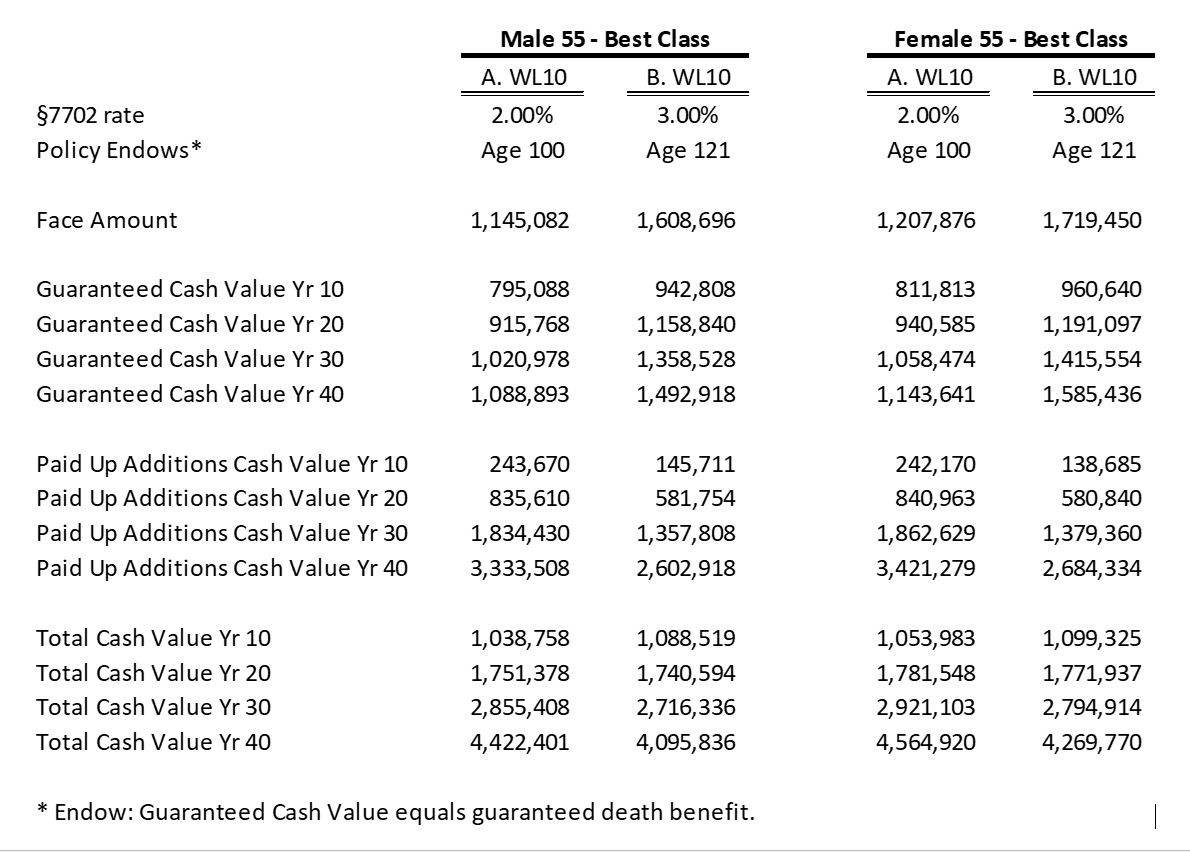

Impact of §7702 change – A lower §7702 rate (for example, 2% rather than 3%) means higher allowable cash value for each dollar of death benefit, which translates into a lower net amount of mortality risk to the carrier (the difference between the total death benefit and total cash value). In layman's terms, products with lower 7702 rates will have less death benefit for every dollar of premium — but as you can see in the following chart, a lower death benefit for whole life limited payment policies does not automatically translate into a corresponding cash value competitive advantage.

TABLE ONE - Policy Values Based on current Dividend Scale and no Policy Loans

The comparisons in Table One demonstrate how guaranteed cash values grow more quickly in the early years, but over time it is the non-guaranteed dividends that truly drive the economic engine that makes whole life a viable financial product. And because of the §7702 rate changes that reduce the required guarantees, dividends buying paid-up additions can become an even greater percentage of the total cash value and death benefit.

These comparisons make it clear that an advisor reviewing a carrier illustration that is focused on cash value and future policy distributions needs to assess the likelihood that the policy will perform as illustrated. That means reviewing the impact of the non-guaranteed elements, dividends and policy loan rates, on said future distributions.

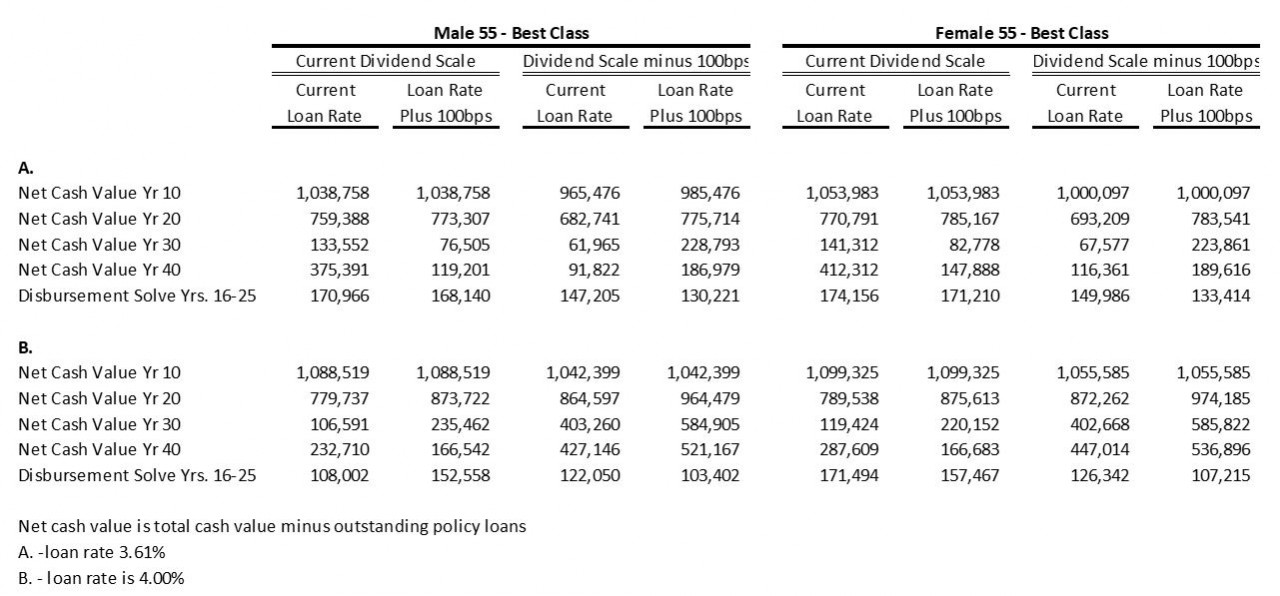

As a rule, just like qualified plans, the longer the money can remain in the plan, growing in a tax advantaged envelope, the more money will be available for ultimate distribution. In the following example, the illustration software solved for the maximum level distributions based on a 15-year accumulation period, followed by 10 years of distributions, making sure that the policy stays in force until maturity. That last part is crucial. To make sure that the policy loans are never taxable, the outstanding policy loan must be repaid by the income tax-free death benefit.

To stress test the illustrated policy performance, we need to look at how changing the dividend crediting rate and the policy loan rate can change our 10 years of distributions. There are 3 ways those non-guaranteed elements can be modified when compared to our benchmark illustration that uses current dividend crediting rates and currently illustrated policy loan rates.

- .Impact of policy loans using current dividend crediting rates and increased policy loan rates.

- .Impact of same policy loans using reduced dividend crediting rates and currently illustrated loan rates.

- .Impact of same policy loans using reduced dividend crediting rates and increased policy loan rates.

Table Two – Impact of Changes in Dividend Crediting Rate and Policy Loan Rates

As you can see, some carriers require significantly less net cash value to maintain policy coverage when compared to other carriers in certain scenarios. It's also apparent that while a 100bps change in the loan rate impacts future values and disbursement amounts, changes in the dividend crediting rate are more impactful to the policy owner.

Advisors must determine whether that cash value cushion is likely to be sufficient under stress or if the distribution amount should be reduced. Similarly, advisors need to make their own professional assessment regarding the dividend crediting rate and future policy loan interest rate assumptions, and then discuss their assessment with the client.

In summary, using whole life insurance to create future cash flow is sometimes promoted, and viewed, as a "get rich quick" scheme that is not for the faint of heart. We disagree. Instead, we see it as a conservative opportunity where the downside risks, and the potential for upside returns, can be fairly and objectively evaluated and presented to your clients as a valuable component to help secure their financial future.

Comments