Life Insurance and Retirement Planning — A View From Outside the Industry

If we had a nickel for every time a carrier suggested we spend more time showing life insurance as a supplemental retirement income strategy, we would have a ton of nickels. After all, Windsor was started by Jerry Schwartz and Hal Brooks when Universal Life and Interest Sensitive Whole Life were first invented. From that time on, we've been steadily promoting the unique advantages of life insurance, most recently in our June 2021 Blog on Life Insurance Retirement Plans (LIRP).

But we have a stake in the game. So when life insurance companies encourage us to emphasize the cash accumulation and tax-advantaged features of their products, whether it be for deferred compensation, executive bonus, split dollar arrangements, key person insurance, or simply as an additional source of income for retirement purposes, they're preaching to the choir. Recently, though, a major accounting firm, Ernest & Young, LLP, extensively examined whether using life insurance cash values to supplement retirement income really made sense when compared with alternative investment strategies. Publishing an 18-page detail-filled exploration of their findings, they explained their approach in their introduction:

"Although facing challenges, the US life insurance and retirement industry has enormous potential to grow. EY researchers estimate that by 2030, there will be a $240 trillion retirement savings gap and a $160 trillion protection gap. Insurers are uniquely positioned to address these gaps with products that offer legacy protection, tax-deferred savings growth and guaranteed income for life.

"In this paper, we explore how two products can be used to meet investors' savings and protection needs: permanent life insurance (PLI) and a deferred income annuity with increasing income potential (DIA with IIP), which represents deferred income annuities with persistency bonuses and non-guaranteed dividends. Our analysis focuses on whether integrating PLI and a DIA with IIP into a financial plan provides value relative to an investment-only strategy. Specifically, we conducted case study analyses to determine the optimal allocation of an investor's assets to the insurance products."

EY goes on to explain their process, which involves "a Monte Carlo analysis to generate 1,000 scenarios, each of which contains a time series of interest rates, inflation rates, equity returns and bond returns across the planning horizon. We then analyze two outcome metrics generated through these simulations."

Their findings were eye-opening:

"More exposure to Personal Life Insurance and DIA with IIP (which both outperform fixed income) produces better retirement outcomes because it does not result in an under-allocation to equity assets earlier in the household's life cycle."

"Allocating up to 30% of annual savings to Personal Life Insurance and up to 30% of wealth at age 55 to DIA with IIP may be appropriate when optimizing retirement income and legacy value outcomes."

"The majority of the integrated strategies [that include Personal Life Insurance] produce higher retirement income and legacy at the end of the time horizon, while the two exceptions provide slightly less income but much higher legacy."

"Our analysis shows that integrating insurance products into a financial plan provides value to retirement investors. Insurers can use these products to strengthen their relationships with investors and seize upon the possibilities in a marketplace that has proved challenging."

[View the full EY Report 'Benefits of Integrating Insurance Products Into a Retirement Plan' here]

If using life insurance as a part of individual retirement income planning is worth a second look, then let us first review how these programs have usually been illustrated and compared.

The traditional LIRP presentation starts with what is typically described as an overfunded policy maximizing cash values while minimizing the death benefit which reduces the policy cost of insurance. Policy distributions are maximized with the policy illustrated to run to maturity so that any outstanding loans are repaid by the death benefit.

Once the amount of distributions is calculated, the policy cash flow (premiums in, distributions out) is plugged into an alternative scenario (often an after tax investment account) using a hypothetical gross investment rate and an assumed tax rate that results in a net investment rate.

Depending on the resulting net investment rate, the alternative scenario will show three possible outcomes:

It will match the projected insurance policy distribution schedule

It will exceed the projected insurance policy distribution schedule

It will fail to achieve the projected insurance policy distribution schedule (it runs out of money)

While the math used in this approach is valid and the assumptions are reasonable, it has always felt a bit incomplete and open to the typical objections of investment advisors ("I can do better" "insurance has too many costs," etc.). The E&Y report addresses these objections in a way we haven't seen previously and got us thinking about a different way to do the comparison.

The core tradeoff between permanent life insurance and the alternative scenario is "costs" vs. "taxes." We took this tradeoff and compared it in two different ways.

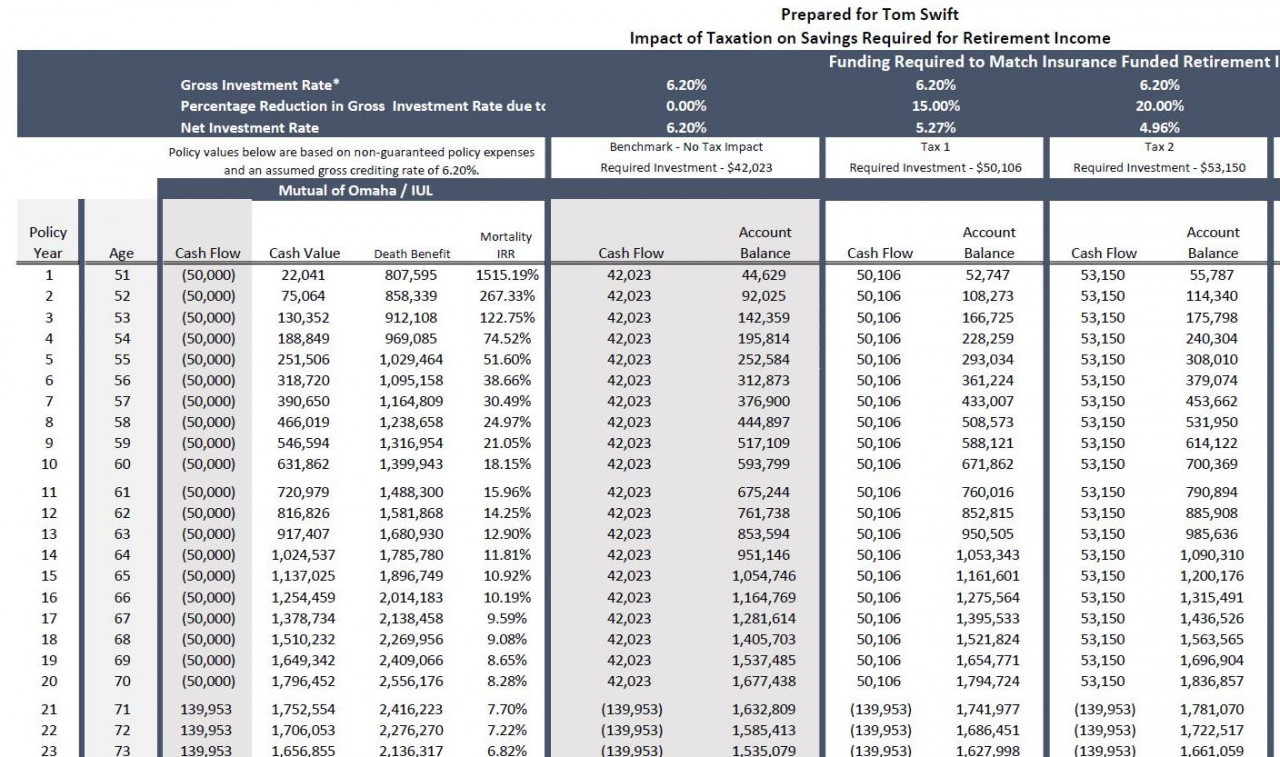

First, we modeled how much money an investor would need to invest annually to match the projected policy performance based on different hypothetical tax rates (click the charts to see the full page reports):

As you would intuitively conclude, the higher the tax bracket the higher the annual contribution to match the life insurance results. By expressing the impact of taxes as additional annual contributions we believe this approach more accurately reflects the "expense" that taxes represent.

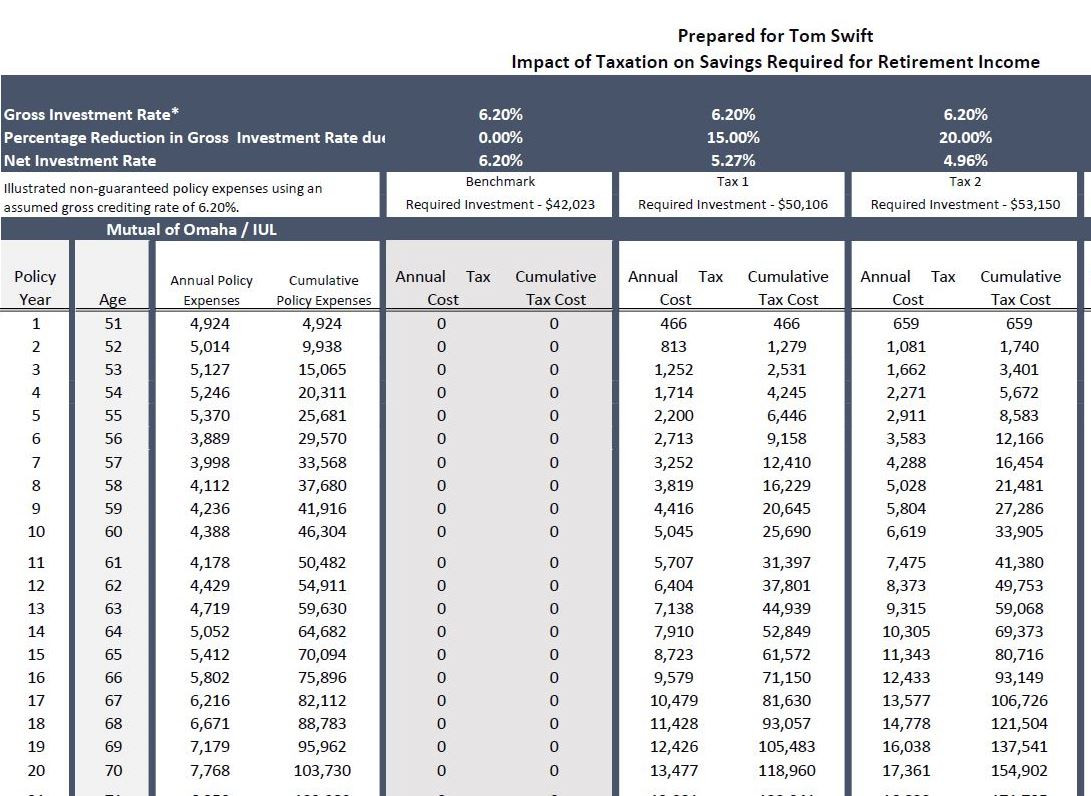

To illustrate this expense comparison in detail we went one step further, comparing the different hypothetical tax rates year-by-year to the internal life insurance policy costs.

Ultimately in all scenarios, except for a zero-tax assumption, cumulative taxes exceed cumulative policy costs. It is just a question of how many years until the cross over point. You can view the full three page Windsor analysis here.

This answers the "life insurance cost" objection, and demonstrates in yet another way the advantages of life insurance when compared to investment vehicles such as stock portfolios. Additionally, unlike paying taxes, paying policy expenses goes toward providing a death benefit for beneficiaries — a benefit unique to life insurance.

E&Y's thorough analysis, from an objective viewpoint outside of the life insurance and annuity industry, is both a valuable and credible reference for the life insurance professional. As the E&Y report points out, not only does the inclusion of permanent life insurance and deferred income annuities enhance retirement income results, it also provides significantly higher legacy benefits. And while boosting the financial well-being of future generations may not always be the primary driver of your client's financial strategy, legacy benefits provide a sense of security and peace of mind that only life insurance can offer. So the next time your client takes exception to the "cost of insurance," call Windsor. We'll be glad to help.

Comments